Cryptocurrency Charts

How to read Cryptocurrency Charts:- Cryptocurrencies can be overwhelming at first. There are a million buzzwords to navigate and once you understand them, they will appear on the chart. Infinite, infinite chart.

However, if you want to be a full-fledged crypto trader, using these charts properly can be a very powerful tool. Knowledge is power, and for many traders, charts are an important part of the decision-making process.

What is a crypto chart? Cryptocurrency charts are just a visual tool to display relevant data in a way that helps you better understand the price fluctuations of cryptocurrencies. The way the

data is displayed identifies patterns of market movement, identifies trends when they are formed, and is an overall bullish (people buy and price up) or bearish (people) market. It helps to get a complete picture of the dynamics. Selling lowers the price). Theoretically, you can use this to predict where the market is heading, what the future price will be when to buy when to sell, and when to HODL.

There are two main formats for stock charts: line charts and candlestick charts. Start with a line chart.

How does a line chart work?

Linear line graph

Line charts are the most basic type of crypto chart. Line charts show past price points for an asset. A green line is displayed in the chart above. This refers to the scale on the right and represents the price of BTC in US dollars (although you can view any local currency). In the case of cryptocurrencies, these usually consist of daily closing prices within a specific time. The chart displays a time frame that can be measured in any length, such as minutes, hours, days, weeks, months, and years. If you are an experienced trader, you will probably want to focus on minutes and hours.

If you are a HODLer looking for a longer-term investment, monthly is more suitable. It’s also important to remember that line charts have two different scales, linear and logarithmic. You can easily switch between them (in the upper right corner of the figure above, but this is not the case). In a line chart, the price scale is divided into equal parts. In the log chart, the crypto price is scaled by the rate of change. Therefore, if the absolute values of the two price changes are different, but the percentages are the same, they are both represented on the logarithmic scale with the same vertical shift Both charts have been used.

Line charts allow you to more accurately measure the speed of price changes, and log-log charts make it easier to find trends.

Logarithmic line graph

On the left side of the chart is the Bitcoin market capitalization axis. This is indicated by the blue line. Bitcoin market capitalization simply refers to the total value of all issued Bitcoins. It is calculated by multiplying the total number of Bitcoins in circulation by the Bitcoin price. This is a good indicator of how investors are currently looking at Bitcoin.

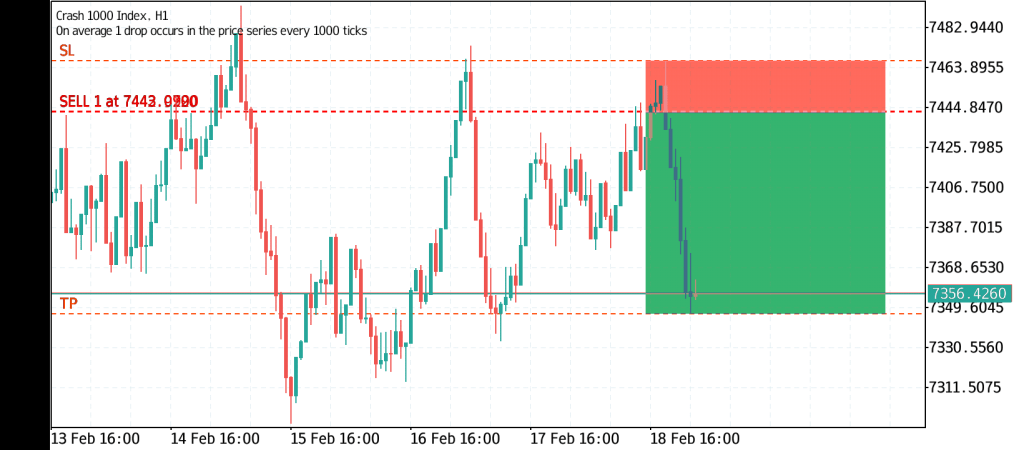

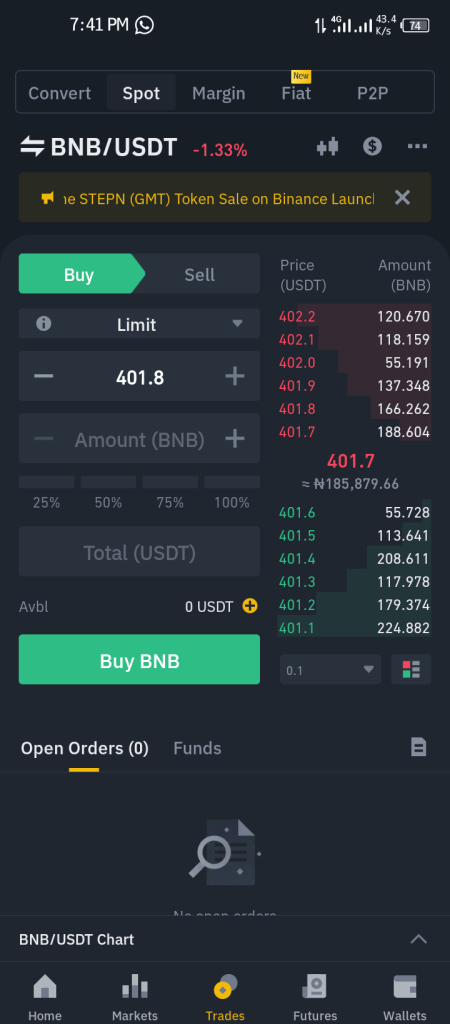

At the bottom of the chart is a black line that represents the past trading volume for 24 hours. This is a useful indicator of whether the price surge can be sustained. Low volume means that the market is not confident and is soaring on a weak foundation. Therefore, prices are likely to fall soon. On the other hand, the higher the volume, the more likely it is that the price will rise. What’s on the candlestick chart? Candlestick charts are more advanced trading tools with additional useful information. Popular with crypto traders for use in technical analysis. Learn more about technical analysis.

Candlestick chart

Candlestick charts may look intimidating at first but once read, they are easier to understand. The x-axis shows time and the y-axis shows the price. So far, it’s similar to a line chart. The big difference is the chandelier. Candlestick charts are so-called because each plot point on the chart looks like a candlestick. They are

red (or pink) or green rectangles, with lines at the top or bottom, like the core of a candle. Candlestick size, core, and color give you a lot of useful information. The

rectangle itself shows the gap between the starting and ending balances of the coin during the search period. The green candle indicates that the value of the cipher has increased, so the opening price will decrease and the closing price will increase. The red (or pink) candlestick indicates that the price of the crypto has fallen, so the opening price has risen and the closing price has fallen. You may see a symbol that looks more like a cross or a plus sign than a candle. This is called the same thing and means that the opening and closing prices of the day are the same. The “core”, on the other hand, comes out of the top or bottom rectangle. These show the range of highs and lows for the day. For example,

An example of a bearish candlestick pattern is a hanging person. It has the same shape as a hammer, but at the end of the uptrend, the closing price is lower than the opening price in this case.

moving average

Another important line you may encounter when analyzing crypto charts is the moving average index. These lines are based on the average closing price of the coin over a while. This indicator helps you find patterns and determine trends and signals to get in and out of positions. For example, calculate a 50-day moving average by summing the closing prices of each coin on the 50 trading days before that day and dividing by 50.

Suppose you need a 5-day moving average for simplicity. Price actions five days ago were $ 10, $ 8, $ 12, $ 15, and $ 20. Therefore, the moving average is the sum of these numbers divided by 5, which corresponds to 13.

And you have it – the basics of cryptocurrency charts. If you have further questions about the different areas of the average, feel free to contact us on Twitter. In the next blog in this series, we will focus on trend lines, resistance levels, etc., and explain in detail how to use these charts to predict future price fluctuations using technical analysis.