Nigerian banks limit foreign currency spending on naira cards

Nigerian banks limit foreign currency spending on naira cards:- Nigerian banks have reduced their customers’ naira cards monthly spending by 80%, according to a flurry of emails seen by Market Forces Africa as part of compliance with the Central Bank of Nigeria (CBN) directive.

According to the local lenders, the implementation of the directive will commence on 14 March 2022., a decision that lenders said signals today’s economic realities.

Currently, this limitation has affected online payments using naira card payments, The banks announce to their customers that they should obtain dollar cards if they need a high spending limit on their cards instead.

The United Bank of Africa (UBA) was first to decide on February 24 when it announced $20 as its new limit.

“In line with our promise to keep you updated on services, we have reviewed Naira Card limits for international transactions, and this will take effect on 1st of March, 2022,” the bank said.

“Remember you can use your UBA Dollar, Pounds, or Euro Card for international POS, ATM, and web transactions. If you do not have one and would like to subscribe, please visit a branch close to you.”

On Wednesday, Zenith Bank informed its customers that it was reducing its international spending limit on its naira cards to the maximum of $20 and it was suspending international ATMs and point of sales (POS) transactions.

On Friday, First Bank announced that due to “current market realities on foreign exchange,” it had reduced its spending limit to $50.

More banks followed on Saturday, also citing recent economic realities.

The review of transaction limit follows a move by the apex bank to tame foreign currencies outflow due to rising imports bills payments at a time when inflows have been limited despite rising oil prices.

Some analysts however attributed this effort to a capital control strategy to strengthen the local currency. Nigeria’s apex bank has announced a plan to incentivize exporters with rebates on foreign currencies repatriated into the economy as part of the RT200 scheme.

According to the operating guideline for the scheme targeted a $200 billion inflow over 3-5 years; CBN said it will pay exporters N65 for every $1 sold into the economy through the Investors & Exporters window.

Operating Guidelines for RT200 Non-Oil Export Repatriation Rebate Scheme came following the CBN Governor, Godwin Emefiele RT200 program launched at the post-Bankers’ Committee.

RT200 program is designed to help ease the inadequacy of foreign exchange supply and the constant pressure on the exchange rate, Emefiele had explained. CBN said that the RT 200 will help the country raise $200 billion in foreign currencies (FX) earnings from non-oil proceeds over the next 3-5 years.

“The Scheme shall pay, N65 for every dollar repatriated and sold at the Investors and Exporters FX Window to ADBs for other third party use, and N35 for every dollar repatriated and sold into I&E for own use on eligible transactions only”.

In the emails sampled by MarketForces Africa from nearly 10 banks, customers that were allowed to spend $100 per month will have access to just $20 in 30 days for possible FX-related purchases.

Some banks, as result, have indicated that they have suspended the use of naira cards for international automated teller machines, cash withdrawals, and POS transactions in foreign currencies. This review is in response to economic realities today, Zenith Bank said in an email sent to customers.

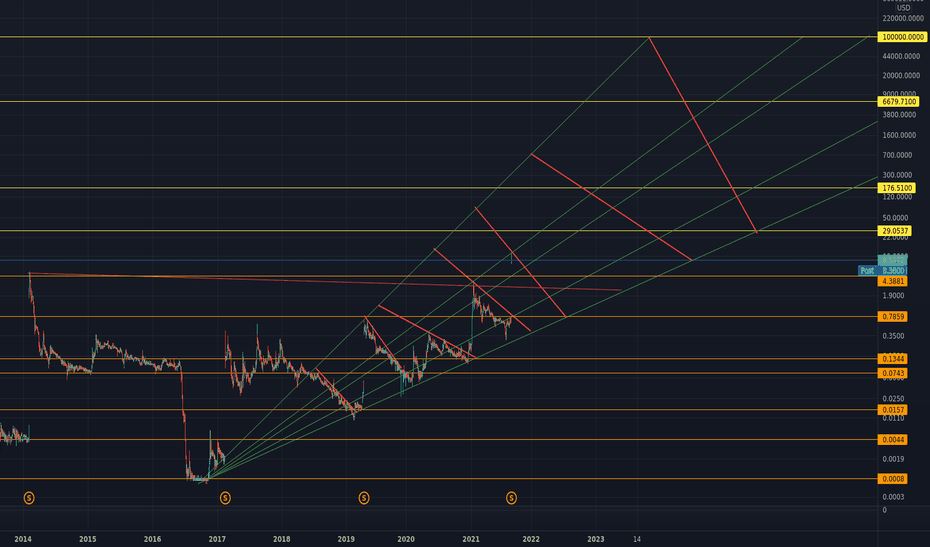

List of Nigerian Banks ATM Cards Spending limits

READ MORE:

Travel Guide For Moving Abroad: 12 Things To Check