Best Cryptocurrency for the Future

-

Bitcoin (BTC)

Market cap: Over $846 billion

Made in 2009 by somebody under the pen name Nakamoto, Bitcoin (BTC) is the first cryptographic money. Similarly, as with most digital currencies, BTC runs on a blockchain, or record-logging exchanges circulated across an organization of thousands of PCs. Since increases to the appropriated records should be confirmed by tackling a cryptographic riddle, a cycle called evidence of work, Bitcoin is guarded securely and from fraudsters.

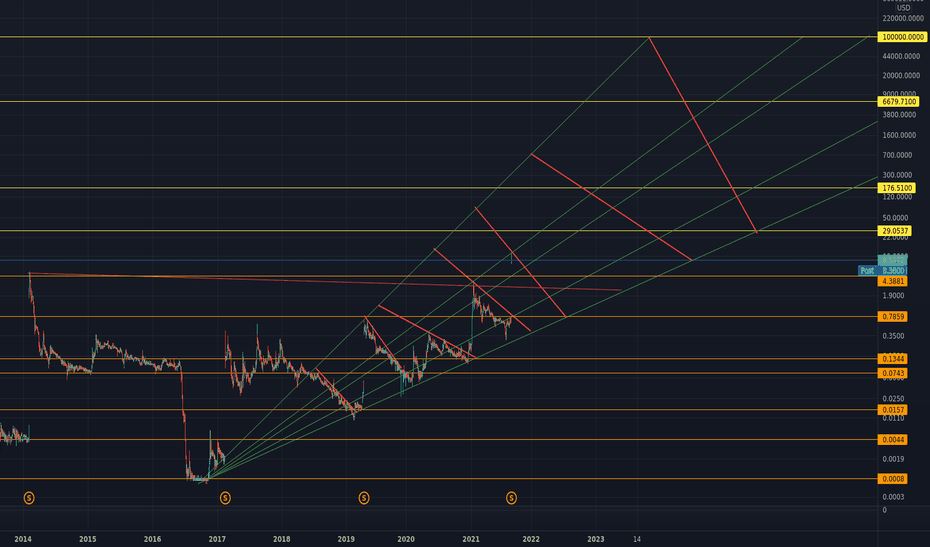

Bitcoin’s cost has soared as it’s turned into a commonly recognized name. In May 2016, you could purchase a Bitcoin for about $500. As of March 1, 2022, a solitary Bitcoin’s cost was more than $44,000. That is a development of around 7,800%.

-

Ethereum(ETH)

Market cap: Over $361 billion

Both cryptographic money and a blockchain stage, Ethereum is a top pick of program designers because of its possible applications, as alleged brilliant agreements that naturally execute when conditions are met and non-fungible tokens (NFTs).

Ethereum has likewise experienced gigantic development. From April 2016 to the start of March 2022, its cost went from about $11 to more than $3,000, expanding by over 27,000%.

-

Solana (SOL)

Market cap: Over $33 billion

Created to assist with fueling decentralized finance (DeFi) utilizes, decentralized applications (DApps), and brilliant agreements, Solana runs on a remarkable crossover verification of stake and evidence of-history components that assist it with handling exchanges rapidly and safely. SOL, Solana’s local token, drives the stage.

Whenever it was sent off in 2020, SOL’s cost began at $0.77. By March 1, 2022, its cost was around $101, an increase of almost 13,000%.

-

Binance Coin (BNB)

Market cap: Over $68 billion

The Binance Coin is a type of cryptographic money that you can use to exchange and pay charges on Binance, one of the biggest crypto traders on the planet.

Since its send-off in 2017, Binance Coin has extended past just working with exchanges on Binance’s trade stage. Presently, it tends to be utilized for exchanging, installment handling, or in any event, booking travel plans. It can likewise be exchanged or traded for different types of digital money, like Ethereum or Bitcoin.

BNB’s cost in 2017 was simply $0.10. By the start of March 2022, its cost had ascended to around $413, an addition of roughly 410,000%.

-

(XRP)

Market cap: Over $37 billion

Made by a portion of similar organizers such as Ripple, advanced innovation and installment-handling organization, XRP can be utilized by that organization to work with trades of various cash types, including government-issued types of money and other significant digital currencies.

Toward the start of 2017, the cost of XRP was $0.006. As of March 2022, its cost reached $0.80, equivalent to an ascent of over 12,600%.

-

USDC COIN

Market cap: Over $53 billion

Like Tether, USD Coin (USDC) is a stablecoin, meaning it’s upheld by U.S. dollars and focuses on a 1 USD to 1 USDC proportion. USDC is controlled by Ethereum, and you can utilize USD Coin to finish worldwide exchanges.

-

Land (LUNA)

Market cap: Over $34 billion

The land is a blockchain installment stage for stablecoins that depends on keeping harmony between two kinds of digital currencies. Land-upheld stablecoins, like TerraUSD, are attached to the worth of actual monetary forms. Their stabilizer, Luna, drives the Terra stage and is utilized to mint more Terra stablecoins.

Land stablecoins and Luna work in the show as per organic market: When a stablecoin’s cost transcends its tied cash’s worth, clients are boosted to consume their Luna to make a greater amount of that Terra stablecoin. Moreover, when its worth falls contrasted with its base money, this urges clients to consume their Terra stablecoins to mint more Luna. As the reception of the Terra stages develops, so too does the worth of Luna.

From Jan. 3, 2021, when its cost was $0.64, to the start of March 2022, Luna has ascended more than 14,200% to $92.

-

Cardano (ADA)

Market cap: Over $33 billion

Fairly later to the crypto scene, Cardano is striking for its initial hug of confirmation of stake approval. This strategy facilitates exchange time and diminishes energy utilization and natural effect by eliminating the serious, critical thinking part of exchange confirmation present in stages like Bitcoin. Cardano additionally works like Ethereum to empower savvy contracts and decentralized applications, which are controlled by ADA, its local coin.

Cardano’s ADA token has had moderately unobtrusive development contrasted with other major crypto coins. In 2017, ADA’s cost was $0.02. As of March 1, 2022, its cost was $0.99. This is an expansion of 4,850%.

-

Tie(USDT)

Market cap: Over $79 billion

Dissimilar to a few different types of cryptographic money, Tether is a stablecoin, meaning it’s upheld by government-issued types of money like U.S. dollars and the Euro and theoretically keeps a worth equivalent to one of those categories. In principle, this implies Tether’s worth should be more predictable than other cryptographic forms of money, and it’s leaned toward by financial backers who are careful about the outrageous instability of different coins.

-

Torrential slide (AVAX)

Market cap: Over $22 billion

Like Ethereum and Cardano, Avalanche gives blockchain programming that can make and execute shrewd agreements controlled by a local token (for this situation, AVAX). Since its send-off in 2020, Avalanche has quickly developed, thanks in no little part to its nearly low gas charges and quick exchange handling speeds.

From July 12, 2020, to March 1, 2022, AVAX’s cost has risen over 1,840%, from $4.63 to $89.84.

*Market covers and evaluating current as of March 1, 2022.