Cryptocurrency (ETF) Exchange-Traded Fund Full Guide on Crypto ETF

What Is a Cryptocurrency (ETF) Exchange-Traded Fund

A cryptocurrency (ETF) Exchange-Traded Fund is an ETF that tracks the value shifts of one or more digital currencies. Fundamentally, it works like a traditional ETF and is traded like a standard share on a stock exchange.

For a cryptocurrency ETF to work, the company issuing and listing it on an exchange needs to bear custody of the underlying digital coin. Then, investors buy shares to represent their rights in the exchange-traded fund. As such, the investors gain indirect exposure to the volatility of the base cryptocurrency.

ETFs provide a less risky way to invest in blockchain-powered assets. In some cases, a blockchain investment may involve buying into a blockchain ETF. Here, an investor interacts with ETFs that mimic the holding stocks of a firm dealing with blockchain technology, the same technology behind digital currencies.

An example of a blockchain ETF is BLOK, which launched in 2018. The exchange-traded fund plows 80% of net assets into firms interacting with decentralized ledger technology (DLT).

Note that for a crypto ETF to be active, it must receive a regulatory green light from financial watchdogs in its preferred operating jurisdictions. For instance, a crypto ETF seeking to attract investments from U.S. residents must get a regulatory nod from the country’s Securities and Exchange Commission (SEC).

What Is an ETF (Exchange-Traded Fund)?

An ETF (exchange-traded fund) is a type of investment fund made up of a collection of securities such as stocks, bonds, commodities, and currencies and is listed for trading on conventional stock exchanges. An ETF tracks the price movements of an underlying asset. Utility tokens, despite being mere virtual currencies, may also be part of an ETF.

ETFs are somewhat identical to mutual funds, except that their shares trade on a 24-hour cycle, similar to directly interacting with a company’s shares on a stock exchange. Mutual funds trading, on the other hand, hinges on its price at the end of a trading day.

An ETF in short will help mainstream finance investors to put their money into Bitcoin and other crypto assets without having to own or manage their crypto, which can get tricky.

Read also: How To Check Airtel Data Balance

Advantages of Crypto ETFs

There are many benefits of cryptocurrency ETFs. These include:

Merging of Traditional Finance and Crypto

Despite hitting over $1.5 trillion in market cap, the crypto market is still minuscule compared to the tens of trillions sitting in large traditional hedge funds, mutual funds, insurance firms, and other institutions.

Crypto ETFs could potentially close the gap between the crypto economy and the rest of the world’s economies. And broader market participation is likely to have a positive impact on the valuations of not only Bitcoin but also the rest of the cryptocurrencies.

Diversification

First, note that an ETF can contain more than one asset. For instance, an Ethereum ETF (despite its name) could also hold Bitcoin or even Facebook stocks. Consequently, it gives investors a way to diversify their portfolios.

This option also helps investors hedge against risks inherent in denominating a portfolio in a single asset. Furthermore, interacting with a regulated stock exchange enables investors to utilize existing portfolios further.

Convenience

Cryptocurrency ETFs mask the hassle of buying, selling, and storing virtual currencies. They also eliminate the need to learn the technology behind blockchain-based assets. Generally, a crypto ETF simplifies mass-market investors’ indirect entry into the crypto ecosystem, while allowing them to gain exposure to major digital assets as a whole, or to specific verticals, such as decentralized finance (Defi) if they invest in thematic ETFs.

Furthermore, the passive nature of ETFs, which automatically rebalance if they are actively managed, allows mass-market retail investors to invest and forget, which is deemed as the investment strategy with the highest return, according to a study by Fidelity Investments.

Efficiency During Tax Filing

The unregulated nature of cryptocurrencies prohibits major bodies such as pension funds from allowing the purchase of digital assets directly, but leveraging regulated platforms such as stock exchanges can allow for the efficient tax filing of cryptocurrency ETFs.

Read Also: How To Check Airtel Data Balance

Greater Confidence

Another advantage of crypto ETFs is that they come from regulated firms and are traded on regulated avenues. Therefore, non-crypto investors can put their money in them with much confidence knowing everything is continuously monitored.

Disadvantages of Crypto ETFs

Despite numerous benefits, crypto ETFs also have their shortcomings. Some factors hindering cryptocurrency ETFs include:

ETFs Are Centralized

Cryptocurrencies have lessened the reliance on centralized financial entities, such as central banks. Additionally, they provide a greater level of privacy compared to government-issued currencies.

While these are good reasons for adopting cryptocurrencies, the use of crypto in ETFs sacrifices one crucial aspect of cryptocurrencies: decentralization. Investing in crypto ETFs means allowing a custodian to hold your digital assets. This leaves crypto ETFs open to the watchful eyes of financial watchdogs, which water down the benefits of decentralization and privacy.

ETFs Are Costly to Manage

The convenience of crypto ETFs comes with a management fee. Since the cost is usually a percentage of the total shares, investments into a cryptocurrency exchange-traded fund can attract high management premiums proportional to the duration of the investment.

ETFs Are Not Tradable with Other Currencies

BTC, ETH, and other currencies are normally tradable against each other on digital currency exchange. Unfortunately, crypto ETFs aren’t tradable with other cryptos. Furthermore, with a crypto ETF, it’s impossible to pay for goods and services, unlike the underlying crypto asset, which some merchants may already accept.

Accuracy Isn’t Guaranteed

We’ve seen that a crypto ETF can contain more than one asset, including non-crypto ones. And although an ETF mimics the price movements of its underlying assets, multiple assets in a portfolio can affect the tracking accuracy. For instance, a 60% increase in ETH’s value may display as a 45% rise in the ETF. Therefore, the tracking may be inaccurate compared with the same asset in the spot market.

Liquidity May Be a Risk

The liquidity risk sets in if the ETF fund manager sells short. When that happens, shareholders pay the price. Additionally, ETFs are likely to cause a dramatic change in the price of tracked cryptocurrencies as more investors are exposed to them.

Regulations in This Industry

The United States Securities and Exchange Commission (SEC), which operates in the largest capital market, regulates ETFs under the Investment Company Act of 1940, which is generally under the same regulatory guidelines as mutual funds and unit investment trusts (UIT).

According to the SEC’s investor alerts for ETFs, regulatory requirements for ETFs include federal securities law and relevant exemptions that are designed to protect investors from risks and conflicts; statutory limitations on the use of leverage and transactions with related parties; exact reporting requirements and disclosure obligation; reviewed by a board of directors.

New SEC Ruling on ETF Regulations

On Sept. 26, 2019, the SEC announced that it has voted to adopt a new rule that would modernize regulations of ETFs. This was done by establishing a transparent, consistent, and efficient regulatory framework so that ETFs do not have to apply for individual exemptions, which takes time and expenses before they go to market.

One year after the introduction of this rule, the SEC halted exemptive relief that was previously authorized for certain ETFs. Therefore, ETFs that rely on this rule will have to comply with the conditions laid out by the SEC to protect investors. Ultimately, a clear and consistent regulatory framework promotes greater innovation and competition within the ETF industry and benefits investors. This is especially true for retail investors (dubbed “main street”), that are increasingly adopting ETF products as part of their investment portfolio, given its low cost and passive investing nature. A record $305 billion flowed into US-listed ETFs, as of June 2021, as compared to $249 billion for the entire year of 2020.

Benefits of Investing in an ETF

While private investors have access to equity in pre-public companies’ fundraises or private funds and institutional investors and family offices are offered exclusive access to financial products with a high minimum investable amount, exchange-traded funds are generally suited for the mass market retail investors. This is due to the small upfront amount required to start investing, extremely low fees (typical ETF expense ratio is around 0.05%), and wide availability on online brokerages.

Furthermore, during the post-pandemic crash and subsequent bull run of 2020, where growth stocks, especially those of technology companies, performed exceptionally well, numerous ETFs made headlines for their stellar performance. One that generated a cult-like following among retail investors is ARK Innovation ETF (ARKK) the star fund manager and founder of Ark Invest — Cathie Wood. The growth-focused fund generated a return of 152.82% in 2020, which is exceptional for an ETF, and when compared to a return of 20.9% in the broad U.S. equities market.

How Will a Bitcoin ETF Work?

The ETFs that are available today (for most of the world, non-Bitcoin ones) can be bought on retail-friendly mobile applications such as the Fidelity app, Robinhood, and TD Ameritrade, and they differ slightly from mutual funds since they trade continuously throughout the day.

A Bitcoin ETF is an exchange-traded fund that tracks the price of BTC, and if it was approved in the U.S., it would be available for trading on traditional stock trading avenues like the New York Stock Exchange (NYSE).

However, as of today, BTC mostly trades on crypto exchanges such as Binance or Coinbase — not in the form of an ETF.

Note that a Bitcoin mutual fund is an investment vehicle under a professional money manager’s stewardship. A Bitcoin ETF, however, gives investors indirect exposure to the leading cryptocurrency without the risks of holding the actual cryptocurrency.

Notably, investors’ stake in the ETF fluctuates according to the price of the top cryptocurrency. Therefore, when the BTC’s value rises, the ETF’s value also increases and vice versa.

Regulators Are Yet to Open the Gates

Unfortunately, regulators in major countries are yet to give a Bitcoin ETF regulatory approval despite a handful of applications. For example, the founders of the Gemini cryptocurrency exchange, the Winklevoss twins, filed an exchange-traded fund tracking the price of the leading cryptocurrency with the SEC. Their application for a Bitcoin ETF was rejected twice by the SEC, the second time in July 2018.

Fortunately, Canadian financial regulators are on the front lines as the first few watchdogs to give the green light for a crypto ETF. In February 2021, the country welcomed a BTC ETF that hit over $420 million in assets under management in 48 hours.

Filed by Purpose Investments, the ETF opened its doors to investors on the Toronto Stock Exchange (TSX) with the symbol “BTCC.”

Another Bitcoin ETF, known by ticker “EBIT,” trades on the TSX and is under the custody of Evolve Funds Group. EBIT gives investors exposure to Bitcoin by tracking its daily price fluctuations in terms of the US dollar.

Ethereum ETF

An Ethereum exchange-traded fund is a crypto ETF that gives investors exposure — via trading on stock exchanges — to the second-largest cryptocurrency. The ETF is comparable with stocks or bonds, only that the underlying asset here is Ethereum (ETH).

Despite numerous filings of an Ethereum ETF in the U.S., the country’s financial watchdog is yet to give a thumbs-up, citing crypto price volatility and security issues.

Canada, on the other hand, is slated to be the first country to approve an Ether ETF, after CI Global announced the CI Galaxy Ethereum ETF in February 2021.

With the price volatility of Ethereum and other digital currencies, crypto enthusiasts view Ethereum ETFs as a great way to invest in the cryptocurrency without buying actual ETH coins. Investing in an ETF also means that people would not have to own the ETH themselves, which could be safer for some investors, as a custodian would typically have more security mechanisms in place than the average investor.

Why Is There No Approved Crypto ETF in the US?

The absence of approved crypto ETFs in the US is largely due to a regulatory environment that concentrates on cryptocurrencies’ unregulated nature. With no central authority and watchdog, the SEC considers the crypto industry prone to manipulation by whales, wealthy investors, and fraudsters.

However, the change in administration in 2021 has seen more pro-crypto individuals head key financial departments. For example, Gary Gensler, a known crypto supporter, was appointed as the SEC’s new head. Consequently, this has increased crypto enthusiasts’ faith that a crypto ETF is on the way.

Moreover, a move by the Ontario Securities Commission to approve a Bitcoin ETF in Canada brings a glimpse of hope that the US is likely to follow the steps.

The Canadian Bitcoin ETF from fund manager Purpose Investments hit staggering sales of over $420 million in over two days when it launched in February 2021.

Closing Thoughts on ETFs

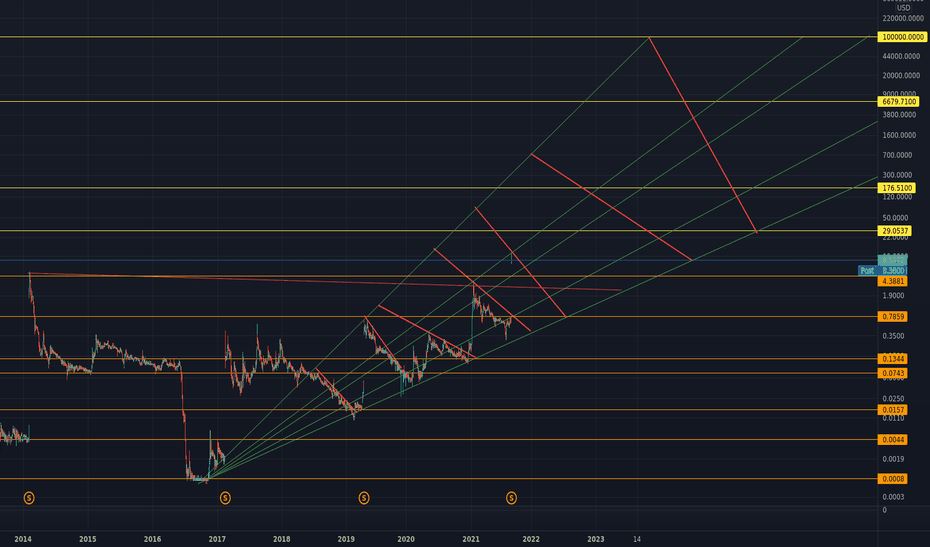

In 2017 and 2018, the SEC cited volatility as the primary reason for rejecting an ETF, a rejection some cite as one of the reasons behind the market downturn at the time. Three years later, the crypto ecosystem has made great strides toward maturity.

We have witnessed that the market efficiency has improved, the regulatory watch has evolved, audit processes have strengthened and advanced custody products are now on the market.

Unfortunately, it’s not yet clear whether the crypto market has fulfilled the SEC’s definition of maturity. Experts such as Cathie Wood, an executive at Ark Investment Management, believe that the crypto industry’s maturity is pegged at a market capitalization of roughly $2 trillion, which is drawing nearer.

In any case, with Gary Gensler in charge of the SEC and many big institutions and high-profile business figures like Paul Tudor Jones, Elon Musk, Stan Druckenmiller, and many more piling in to invest in Bitcoin, the odds have never been better at least a Bitcoin ETF to finally be given the green light by the SEC in 2021.